Asset Aging & Replacement Models: When to Budget for Refresh

Learn how to plan asset refresh cycles using asset aging and replacement models to optimize costs, reliability, and operational continuity.

Introduction

Every organization faces a key question: when should you replace aging assets?

Keeping old equipment too long increases repair costs and downtime, but replacing too early wastes capital.

Asset aging and replacement models help you strike the right balance — combining data, depreciation, and performance indicators to decide when to refresh your inventory.

In this guide, we’ll break down practical methods to model asset life cycles, assess replacement timing, and plan refresh budgets strategically.

1. Understanding Asset Aging

Asset aging refers to tracking the time elapsed since an asset was purchased or deployed, compared to its expected lifespan.

Each asset has a unique “aging curve” — influenced by:

- Usage frequency

- Maintenance quality

- Environmental conditions

- Manufacturer reliability

By mapping these patterns, you can forecast when equipment performance will decline and costs will rise.

Example Lifespans by Category

| Asset Type | Typical Lifespan | Aging Risk Factors |

|---|---|---|

| Laptops | 3–5 years | Battery wear, software bloat |

| Vehicles | 5–8 years | Mileage, mechanical stress |

| Furniture | 8–10 years | Physical damage, obsolescence |

| Lab Equipment | 5–7 years | Calibration drift, precision loss |

2. The Cost-Benefit Challenge

Organizations often struggle between run-to-failure and planned replacement approaches.

| Strategy | Pros | Cons |

|---|---|---|

| Run-to-Failure | Maximizes use value | Unpredictable costs, downtime |

| Planned Replacement | Predictable budgeting | May retire working assets early |

If you’re deciding between planned and reactive upkeep, start with: Preventive vs Reactive Maintenance: Cost Comparisons.

The key is data-driven replacement — using metrics to identify when maintenance cost surpasses replacement cost.

3. Key Asset Replacement Models

1. Straight-Line Depreciation Model

Assets lose value evenly over time.

Useful for stable, low-maintenance equipment.

For a deeper accounting lens on depreciation methods, see: Asset Depreciation Methods Explained.

Formula:

(Cost - Salvage Value) / Useful Life = Annual Depreciation

2. Declining Balance Model

Assets lose value faster in the early years.

Ideal for technology that rapidly becomes obsolete.

3. Condition-Based Replacement

Uses real-time data such as maintenance history or performance indicators.

Best for assets with variable lifespans, like industrial tools.

4. Total Cost of Ownership (TCO) Model

Adds up all costs — purchase, operation, maintenance, and downtime.

Helps justify proactive replacements for efficiency.

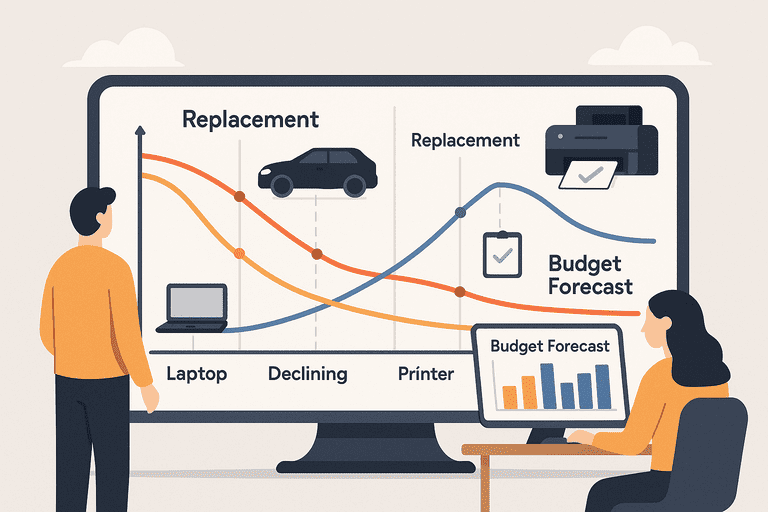

4. Identifying the Optimal Replacement Point

Use cost crossover analysis to find when replacement becomes cheaper than retention.

Example:

If laptop repairs average €200 per year and new models cost €900 with a 4-year lifespan, replacing at year 4 might yield lower long-term costs.

Visualizing this crossover helps you pinpoint the financial sweet spot.

5. Maintenance and Performance Data

Tracking the following indicators helps refine your replacement models:

- Repair frequency (how often assets fail)

- Downtime duration (impact on productivity)

- Energy efficiency trends

- User complaints or performance metrics

Aging assets often show patterns before they fail completely — detecting them early prevents unplanned disruptions.

6. Refresh Budget Planning

A. Categorize Assets

Group assets by function and criticality:

- Critical (e.g., servers, medical devices)

- Standard (e.g., laptops, monitors)

- Low-priority (e.g., furniture)

B. Assign Replacement Thresholds

Define rules like:

- Replace laptops every 4 years

- Replace printers after 30,000 pages or 3 repairs

- Replace vehicles after 6 years or 100,000 km

C. Create a Rolling Refresh Schedule

Instead of replacing everything at once, spread replacements evenly to balance budgets over multiple quarters or fiscal years.

7. Communicating the ROI of Replacements

Finance teams respond to data — not intuition.

Support your refresh proposal with:

- Cost comparison tables (repair vs. replacement)

- Downtime loss estimates

- Residual value of retired assets

- Improved efficiency metrics

A structured model builds trust and simplifies budget approvals.

8. Building Predictive Insights

Advanced analytics tools can:

- Forecast replacement timelines

- Track performance degradation

- Trigger alerts when costs exceed thresholds

Even without AI, structured maintenance data and asset logs can yield strong predictive insights over time.

To connect maintenance history to budgeting and forecasts, read: Linking Asset Maintenance Data to Accounting and Budget Forecasting.

If you’re a small IT team deciding between 3-year vs 4-year laptop cycles (and want templates), see: Laptop Refresh Cycle Policy: 3-Year vs 4-Year.

Conclusion

Asset aging and replacement modeling ensures that every refresh decision is informed, timely, and cost-effective.

By monitoring lifecycle data, understanding depreciation, and applying replacement thresholds, your organization can reduce downtime and optimize capital investment — without waste.

Related reading

Try InvyMate

Start tracking assets with QR codes and scheduled audits.