Asset Depreciation Methods: Explained with Examples

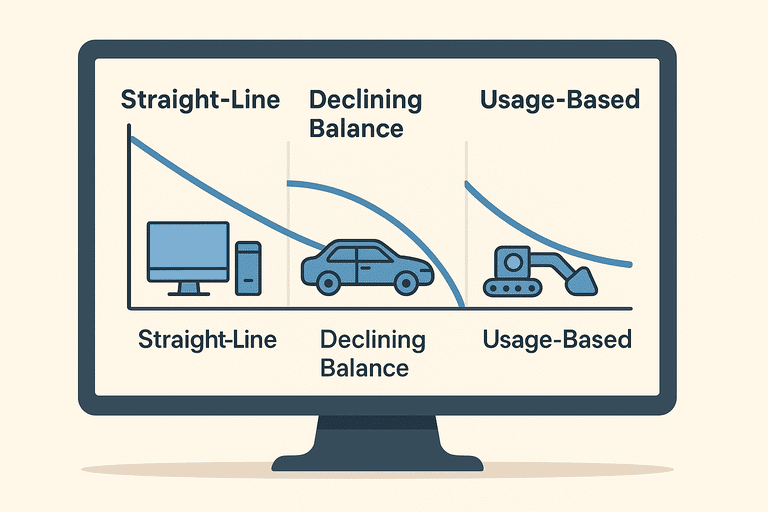

Learn how different asset depreciation methods—straight-line, declining balance, and usage-based—impact your financial reporting and asset lifecycle strategy.

Introduction

Every business owns assets that lose value over time—computers, office furniture, machinery, vehicles, or even specialized tools. Accurately tracking this decline in value isn’t just an accounting formality—it directly affects your balance sheet, budgeting, and long-term decision-making.

If you’re connecting depreciation to broader financial workflows, see: Inventory Management Integrations with Accounting Software.

This guide explains the three most widely used asset depreciation methods—Straight-Line, Declining Balance, and Usage-Based—and helps you understand when and why to apply each one.

1. What Is Asset Depreciation?

Depreciation is the systematic reduction of an asset’s value over its useful life. It reflects how the asset’s ability to generate value decreases as it’s used, aged, or replaced by newer models.

Depreciation helps:

- Align expenses with revenue over time

- Provide a realistic picture of net worth

- Support tax compliance and financial audits

- Guide replacement and maintenance planning

Without a proper method, financial statements can become misleading—overstating profits or undervaluing real-world wear.

2. Straight-Line Depreciation

Definition:

The Straight-Line method evenly spreads the asset’s cost across its useful life. It’s simple, predictable, and widely accepted for most office or administrative assets.

Formula:

Annual Depreciation = (Asset Cost - Salvage Value) / Useful Life

Example:

If a laptop costs €1,500, expected to last 3 years, and its salvage value is €300:

(1500 - 300) / 3 = €400 depreciation per year

Best for:

- Furniture

- Computers

- Fixtures

- Office equipment

Advantages:

- Easy to calculate and audit

- Stable expense recognition

- Compatible with most accounting systems

Drawbacks:

- Doesn’t reflect heavy front-loaded usage

- May understate depreciation for fast-aging tech assets

3. Declining Balance Depreciation

Definition:

The Declining Balance method accelerates depreciation—higher expense early in the asset’s life and lower later. This mirrors how assets like technology or vehicles lose value faster in the beginning.

Formula:

Depreciation Expense = Book Value × Depreciation Rate

Example:

For a €10,000 server with a 30% annual rate:

Year 1: €3,000

Year 2: €2,100

Year 3: €1,470 …

The book value shrinks each year, but depreciation slows down.

Variants:

- Double Declining Balance (DDB) doubles the rate of straight-line depreciation.

- 150% Declining Balance applies a 1.5x factor for moderate acceleration.

Best for:

- IT infrastructure

- Vehicles

- High-tech equipment

Advantages:

- Reflects real-world value loss

- Matches early high productivity with higher expense

- Tax-efficient for fast-depreciating assets

Drawbacks:

- Complex to manage manually

- May distort results if applied inconsistently

4. Usage-Based (Units of Production) Depreciation

Definition:

Depreciation tied to actual usage—machine hours, miles driven, or production units. It reflects wear based on activity, not time.

Formula:

Depreciation Expense = (Asset Cost - Salvage Value) × (Units Used / Total Units)

Example:

If a generator costs €8,000, lasts 4,000 hours, and has €1,000 salvage value:

In a year it runs 1,000 hours →

(8000 - 1000) × (1000 / 4000) = €1,750 depreciation

Best for:

- Manufacturing equipment

- Construction tools

- Vehicles with mileage tracking

Advantages:

- Realistic and fair

- Links cost to asset performance

- Ideal for variable workloads

Drawbacks:

- Requires accurate usage tracking

- Not always accepted for tax purposes

5. Choosing the Right Method for Your Business

| Criteria | Straight-Line | Declining Balance | Usage-Based |

|---|---|---|---|

| Simplicity | ★★★★★ | ★★★☆☆ | ★★☆☆☆ |

| Accuracy (for wear) | ★★★☆☆ | ★★★★☆ | ★★★★★ |

| Suitable For | Office, admin assets | Tech, vehicles | Industrial, heavy-use |

| Tax Efficiency | Moderate | High | Moderate |

| Audit Clarity | High | Moderate | Moderate |

General recommendations:

- Use Straight-Line for stable, predictable assets.

- Apply Declining Balance for assets that lose efficiency fast.

- Choose Usage-Based when asset performance data is available.

Depreciation choice also impacts refresh timing—pair it with lifecycle planning in: Asset Aging & Replacement Models: When to Budget for Refresh.

6. Common Mistakes in Depreciation Tracking

- Ignoring partial months or mid-year acquisitions — always prorate.

- Not updating useful life after refurbishments or upgrades.

- Mixing depreciation methods across asset classes inconsistently.

- Failing to remove disposed assets from depreciation schedules.

- Overlooking tax rule differences (GAAP vs IFRS, local regulations).

For audit-friendly disposal records (and avoiding “ghost assets”), see: Auditable Asset Disposals: Best Practices.

Conclusion

Depreciation isn’t just an accounting formula—it’s a lens on how your organization’s resources evolve. Choosing the right method improves cost forecasting, audit readiness, and strategic planning for replacements.

A well-structured depreciation schedule turns static accounting data into actionable operational insight.

Related reading

Try InvyMate

Start tracking assets with QR codes and scheduled audits.